Cross-cutting environmental solutions, adapted to all sectors of activity

Much more than just reporting software, Green Score Capital has developed an environmental and financial intelligence tool to serve the economic performance of companies and those who finance them.

Current challenges: Anticipating the impact of environmental and financial risks

Companies are facing increasing pressure to integrate environmental risks and their financial consequences into their strategy:

- Economic costs of climate disasters, biodiversity loss, resource depletion, and supply chain disruptions

Direct impact of environmental risks on asset valuation and corporate financial performance - Increased demands from investors and consumers for sustainable commitments

- Regulations and ESG transparency obligations

Our solution: Strategic intelligence tailored to your challenges for optimal decision-making.

Unlike traditional reporting tools, our software leverages satellite data and predictive analytics to provide a dynamic and actionable view of environmental risks and their financial impact. It enables:

- A precise mapping of biodiversity risks affecting your operations, whether in terms of supply or at your production sites.

- Financial optimization by reducing losses and improving the resilience of your assets from the outset, even before you commit to an investment.

- Simplified compliance with ESG regulatory obligations thanks to a respected international scientific framework.

From concrete applications for various sectors of industry to the financial sector, satellite data allows stakeholders to make informed decisions.

The power of satellite data

at the service of your financial performance

Our solution, a SaaS platform developed at the intersection of space technology and predictive modeling, offers an accurate and reliable method for assessing the impact of human activity on biodiversity.

Measuring the five pressures on biodiversity habitat degradation, resource overexploitation, climate change, pollution, and invasive species using geospatial data allows us to:

- Reduce financial risks related to biodiversity by up to 30%[1]: Precise identification of environmental risks enables corrective measures (supplier diversification, adaptation of business models) and thus limit financial losses.

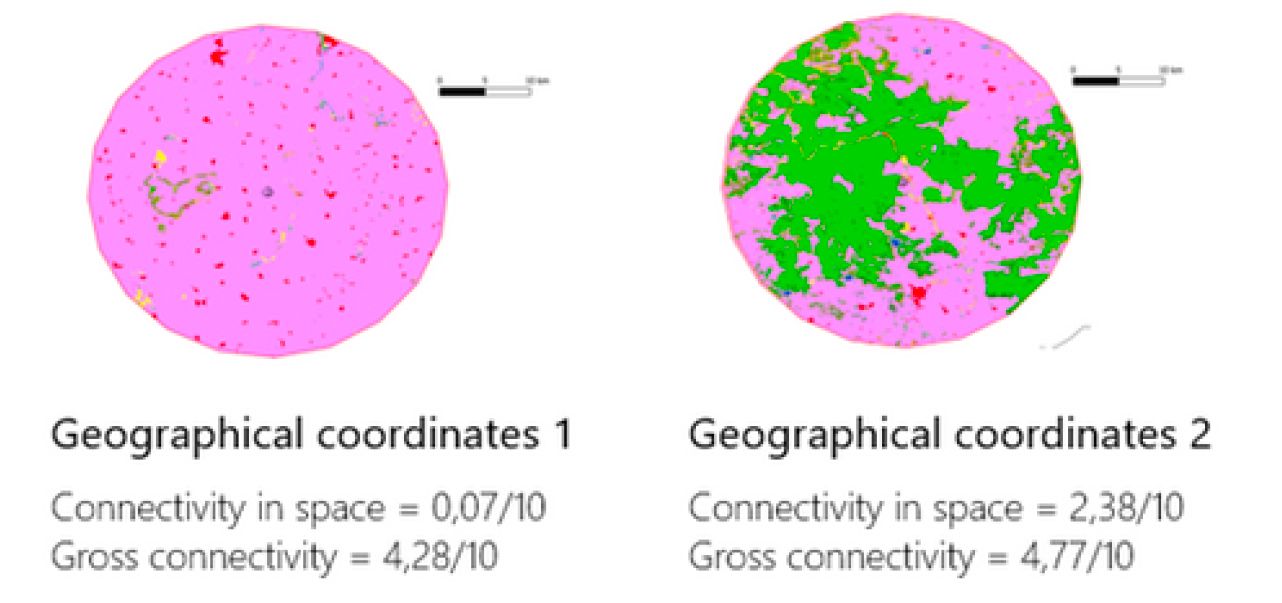

- Identify five times more specific risks[2]: Compared to traditional ESG assessments, which often rely on global data and sector averages, a spatial approach allows for much more precise detection of localized risks.

- Improve risk-adjusted returns by 15%[3]: Better management of environmental risks can improve financial performance by reducing unforeseen costs related to raw material shortages, regulations, or supply chain disruptions.

Practical applications tailored to each sector:

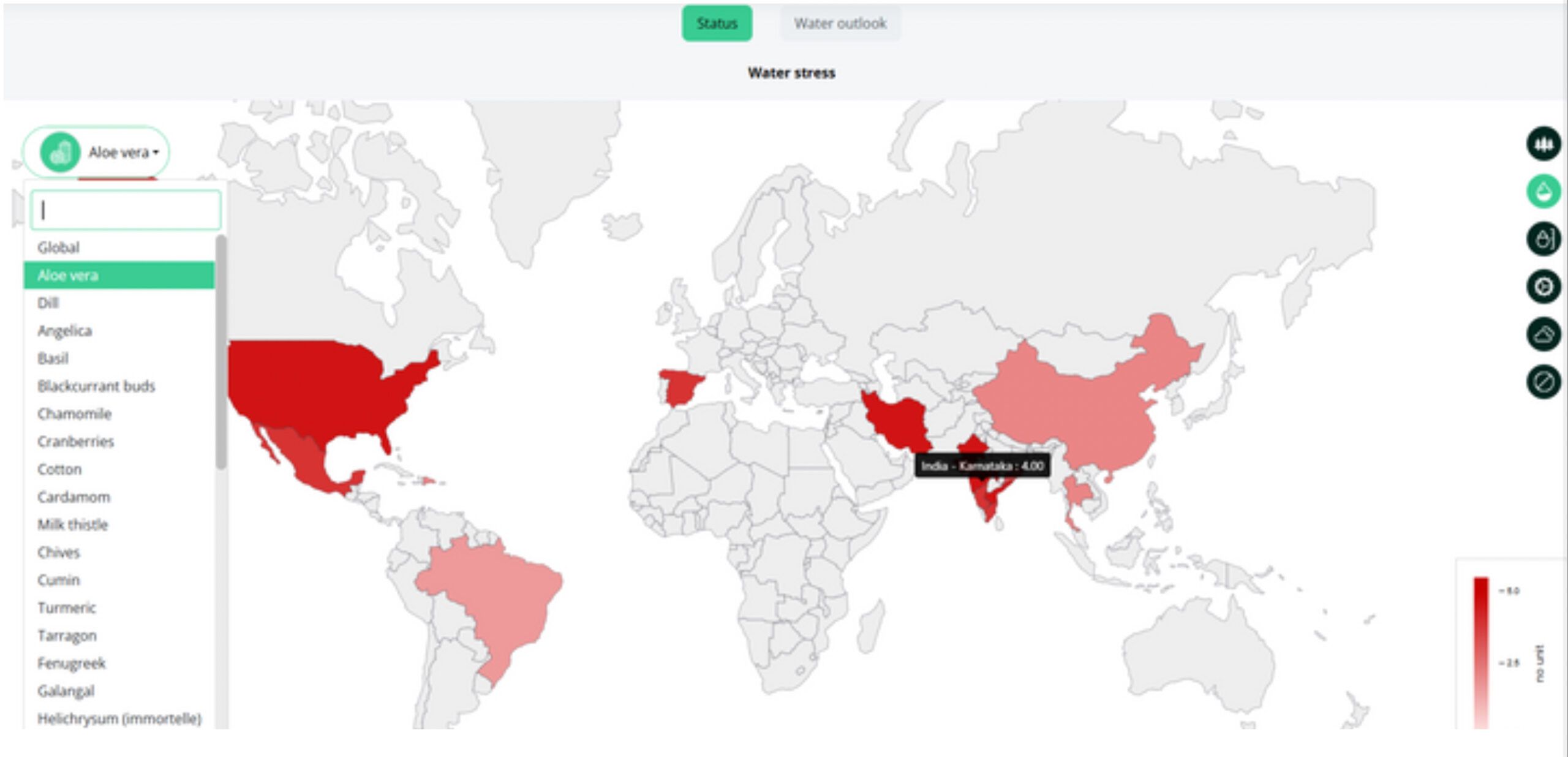

- Industry, Cosmetics & Supply Chain: Environmental risk assessment of supply sources based on raw materials and production sites, while incorporating a forward-looking perspective on parameters that could affect raw material yields.

- Finance & Insurance: Biodiversity risk assessment and ecosystem impact assessment of financed or insured projects, and anticipation of default risks due to environmental issues.

A true decision-making tool, our SaaS platform integrates seamlessly with your information system.

Strategic partners: By partnering with major players, the company allows brands to directly visualize the impacts in the partner tool and make informed decisions.