Integrating the environmental dimension into the analysis of risks and financial performance

More than just reporting software, Green Score Capital has developed an environmental and financial intelligence tool to drive economic performance.

Current challenges: Anticipating the impact of environmental and financial risks.

For the banking sector, the lack of environmental risk assessment exposes it to depreciated assets, increased volatility, and financial losses. Today, these risks are often ignored due to a lack of suitable tools. Our solutions allow you to integrate these parameters from the initial analysis of financing and loan portfolios, to secure your decisions, strengthen the resilience of your assets, and optimize your financial performance.

Our solution: Strategic intelligence tailored to your challenges for optimal decision-making

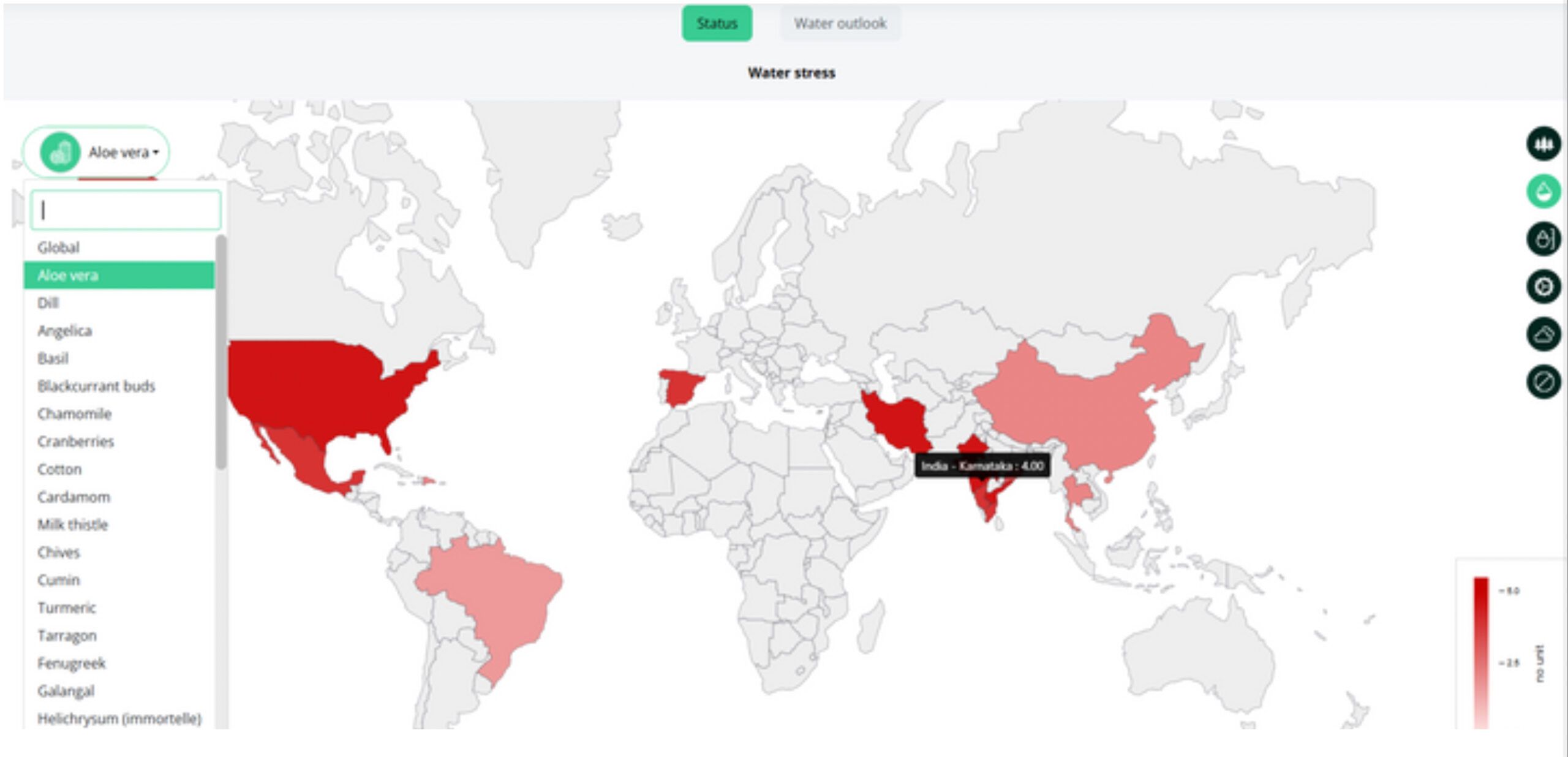

Secure your funding by anticipating biodiversity risks:

- Assess biodiversity during project evaluation with satellite-accurate data to identify funding risks.

- Make informed decisions based on information about habitat, water resources, and ecosystem health.

- Leverage our predictive models to simulate the environmental impacts of proposed projects, enabling you to anticipate and mitigate risks.

- Assessment of ecosystem quality: Quality of ecological corridors, richness of local biodiversity, water stress, overconsumption of water, risk of deforestation, etc.

- Prospective view of climate indicators: Evolution of temperatures, drought levels, and floods according to established IPCC scenarios

Maximize the resilience of your loan portfolio:

By proactively identifying at-risk assets, you optimize risk management and align your environmental policy with new ESG requirements.

Boost the performance of your investments by anticipating environmental risks on raw materials:

Better market forecasting allows for strategic and optimized decision-making. By mapping the environmental risks associated with raw materials, you reduce your exposure to unforeseen fluctuations.

Strategic partners: By partnering with major players, the company allows brands to directly visualize the impacts in the partner tool and make informed decisions.

The power of satellite data

at the service of your financial performance

Our solution, a SaaS platform developed at the intersection of space technology and predictive modeling, offers an accurate and reliable method for assessing the impact of human activity on biodiversity.

Measuring the five pressures on biodiversity habitat degradation, overexploitation of resources, climate change, pollution, and invasive species in a geospatialized manner allows us to:

- Reduce biodiversity-related financial risks by up to 30% [1]: Accurate identification of environmental risks enables corrective measures (supplier diversification, adaptation of business models) and thus limits financial losses.

- Identify 5x more specific risks [2]: Compared to traditional ESG assessments, which often rely on global data and sector averages, a spatial approach allows for much more precise detection of localized risks.

- Improve risk-adjusted returns by 15% [3]: Better management of environmental risks can improve financial performance by reducing unforeseen costs related to raw material shortages, regulations, or supply chain disruptions.